As businesses grow and onboard more employees over time, establishing financial benefits like retirement plans is a crucial way to attract and retain top talent. Even a business with just a handful of employees can benefit from offering a retirement plan. Small business owners often overlook this benefit and can be confused regarding where to get started. As a guide for your own business, here are the most common employer-provided retirement savings plans and how they work:

401(k)

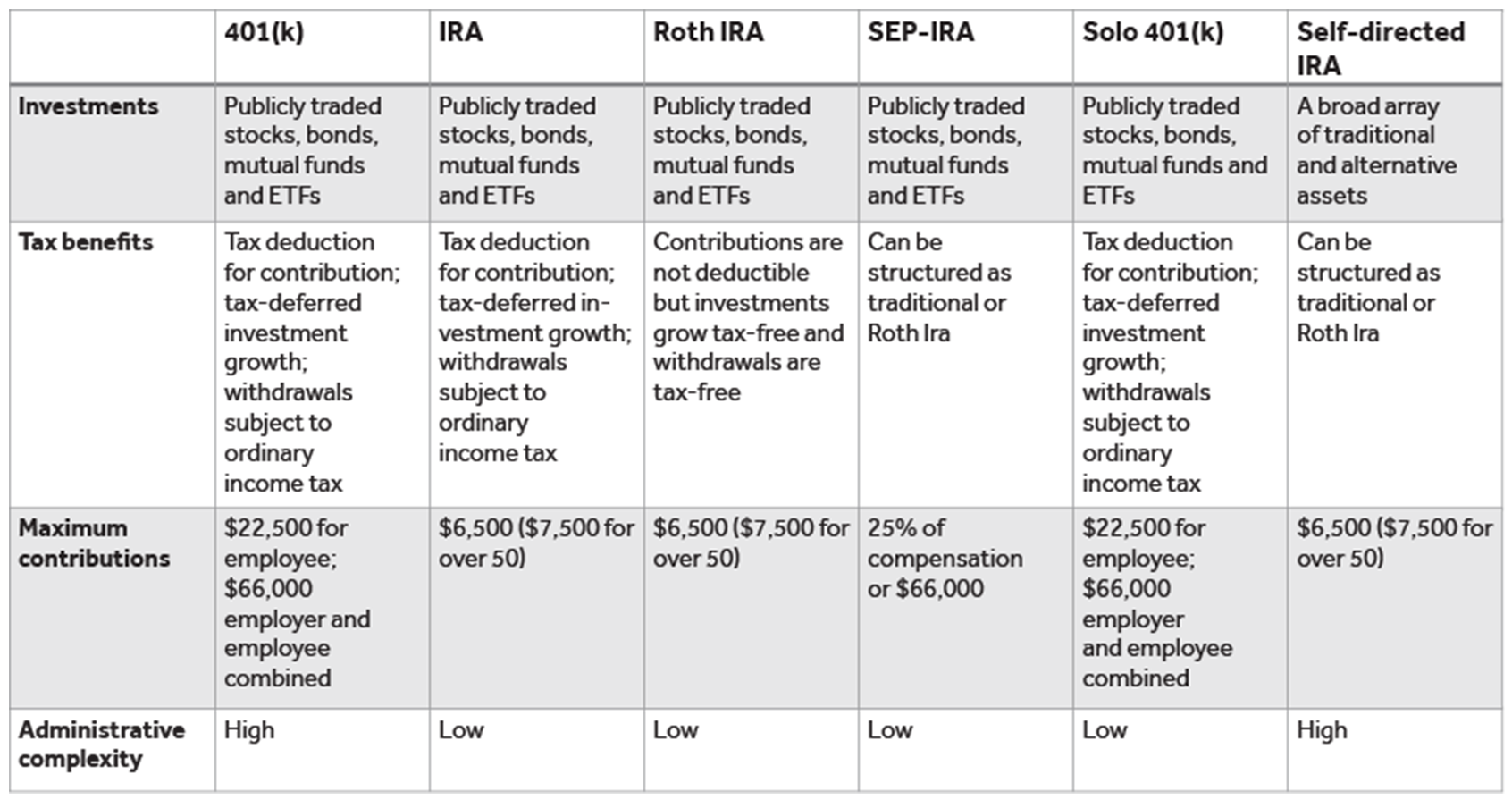

In a 401k, employees contribute a portion of their earnings into a tax-deferred retirement account. They get an immediate tax deduction for the amount they contribute, and they pay no taxes on growth in their account until they withdraw money after retirement. At that point, they pay ordinary income taxes on the amount they withdraw.

Most 401(k) plans allow participants to decide how to invest their contributions, choosing from a menu of diversified mutual funds or ETFs. Many also permit loans and early withdrawals while also charging a penalty fee, allowing employees to access funds before they reach retirement age, if needed. Employers can also contribute to these accounts on behalf of their employees though they are not required to do so.

Any size company can establish a 401(k), even if they are comprised of a single person. Companies with 100 or fewer employees can establish a SIMPLE 401(k), which has fewer administration and reporting requirements than traditional 401(k)s. In contrast, a Traditional 401(k) will have more administrative requirements, but offer higher contribution limits.

IRA/Roth IRA

Small business owners can also fund their own retirement, and that of their employees, through traditional and Roth IRAs. These are relatively simple, low-cost benefits that may make sense for smaller businesses.

In a traditional IRA, you make tax-deductible contributions to your account and pay taxes when you begin withdrawing money for retirement. In contrast, with a Roth IRA, you get no up-front tax benefit for making a contribution, but the amounts you withdraw upon retirement are tax free. Both have relatively low maximum contributions of $6,500 per year or $7,500 if you’re over the age of 50.

IRAs and Roth IRAs are typically used by individuals to fund their retirement, but business owners can make this benefit available to their employees by establishing a Payroll Deduction IRA. Employees elect to make regular contributions to an IRA out of their paychecks, and the employer sets up an automatic withdrawal from payroll into the IRA account. Payroll Deduction IRAs can be set up as Roth or traditional IRAs, and they are subject to the same maximum contribution limits as individual IRAs.

SEP IRA

A SEP IRA, or simplified employee pension IRA, enables business owners to contribute to their own and their employees’ retirement through individual retirement accounts. They are relatively straightforward to set up and administer, so they can be suitable for smaller businesses.

SEP IRAs offer the same tax benefits as traditional IRAs with tax-deductible contributions and investment income that grows tax-free. Participants pay ordinary income taxes on withdrawals.

The main advantage in this case over traditional IRAs is higher contribution limits. Participants can contribute as much as 25% of compensation up to a maximum of $66,000 for 2023, and these limits are adjusted annually for inflation.

Employers are required to contribute the same percentage of salary for all employees. So, if you contribute 5% of your earnings to your own account, you will have to also contribute 5% of salary for each of your employees. These contributions are tax deductible for your business.

Employees can also make personal, non-SEP contributions to these accounts up to the maximum contribution limits. In 2023, that’s $6,500 for employees under 50 and $7,500 for employees over 50.

Solo 401(k)s and Self-Directed IRAs

Many of the retirement programs we’ve discussed are simple enough that they can work for a one-person business. However, there are two options specifically designed for sole proprietors and single-person companies.

A solo 401(k) allows business owners to contribute up to 100% of their earned income on their own behalf, with an annual contribution limits of $22,500 in 2023 ($30,000 if the business owner is older than 50). The company can also make contributions up to 25% of compensation.

Solo 401(k)s have similar tax benefits to traditional 401(k)s in that you can deduct both individual and corporate contributions from your taxes, and investment income accumulates tax free until you withdraw assets. Similarly, you pay regular income tax on the amounts you withdraw.

Most retirement plans, including 401(k)s as well as traditional and Roth IRAs, require participants to invest in publicly traded securities like stocks, bonds, mutual funds, and ETFs. If you want to invest in more diverse assets such as precious metals, commodities, private debt and equity, and real estate, you may want to consider a self-directed IRA (SDIRA). These accounts allow for more investment options, but they otherwise work exactly like IRAs. They can be set up as traditional or Roth SDIRAs, and they are also subject to the same tax rules and investment maximums as traditional and Roth IRAs.

Not all investment providers offer SDIRAs. Keep in mind also that with a self-directed IRA, you are assuming all responsibility for your investment decisions. SDIRA providers cannot and do not provide investment education or advice, so they are best for experienced and knowledgeable investors.

Providing your employees with retirement savings plans is an important part of maintaining a committed workforce. You can show your dedication to their well-being and help to build loyalty and attract new candidates as your business grows.

Navigating the wide range of retirement plan options can be challenging but be sure to take the time to review and understand what is available before making a decision. A financial professional specializing in small businesses can guide you regarding what makes the most sense for you, your company, and your employees.

This article is provided for general informational purposes only. Neither New York Life Insurance Company, nor its agents, provides tax, legal, or accounting advice. Please consult your own tax, legal, or accounting professional before making any decisions.

SMRU #5500520.1 exp.?3/14/2025